Market capitalization (market cap) isn’t a new concept, but rather a term borrowed from the finance world. In NBA Top Shot, a moment’s market cap can be calculated by multiplying the current lowest asking price by the moment’s circulation count. For example, if a moment has a lowest asking price of $100, and a circulation count of 1,000, the market cap is $100k ($100 x 1,000). Calculating a single moment’s market cap leaves you with nothing more than a fun fact, but things become far more interesting when you start comparing market caps - let’s dive in.

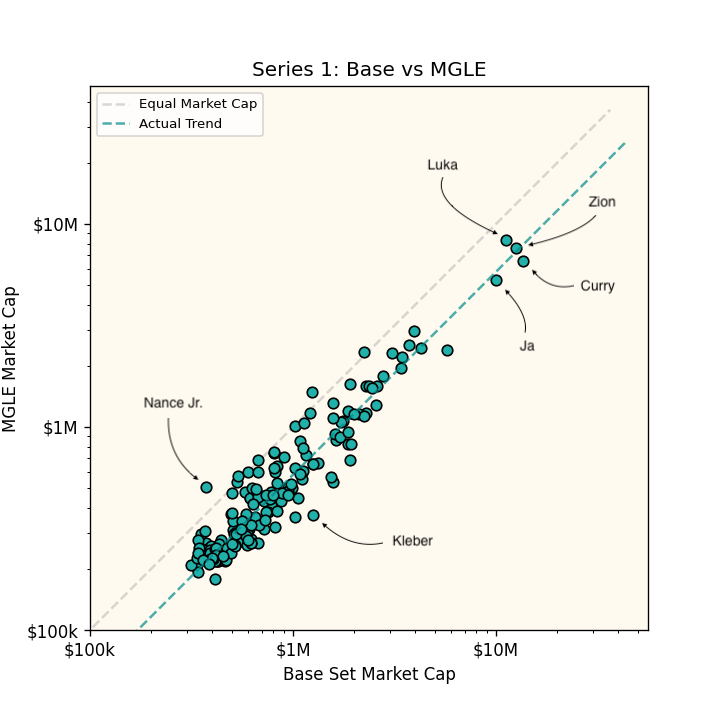

Series 1: Base Set vs MGLE

On paper we might expect a player’s market cap to be roughly equal across their moments (particularly in the same Series) but let’s take a closer look. Consider Dejounte Murray’s Series 1 Base Set and MGLE moments below:

Doing the math, we see that the Base moment has a market cap of $1.02M and the MGLE moment has a market cap of $630k - noticeable less. To visualize this relationship we can create a chart with Base moment market cap on one axis, and MGLE moment market cap on the other.

Before we jump to any conclusions, let’s gather some more data. Specifically, we can calculate the market cap values for each of the 181 moments Series 1 moments that have both a Base and MGLE version. For a bit of data cleanliness, we’ll also filter out moments that fewer than 10 active listing, bringing our full dataset down to 169 moments.

Looking at the full picture, there definitely appears to be a linear relationship between the market cap of a player’s Series 1 Base and MGLE moments. Doing the math, this relationship works out to be:

MGLE = (0.58 * Base) + 32,500In other words, a moment’s MGLE market cap is equal to 58% of its Base market cap, plus $32,500. Let’s go ahead and add this line to our chart, as well as highlight some players that stand out.

Not surprisingly, our usual suspects are at the top of the class: Luka, Zion, Curry, and Ja. Despite their large market cap values, the relationship between their Base and MGLE moments is in line with the rest of the pack. Two other players that catch my eye are Larry Nance Jr. and Maxi Kleber. both of these players sit noticeably far away from the general trend, and in Nance Jr.’s case, his Series 1 MGLE moment actually has a greater market cap than his Base moment. Let’s dive into these two players to try and understand what’s going on.

Larry Nance Jr.

Focusing in on Nance Jr., we can see just how far away his moments are from the general trend of other Series 1 moments. The market cap values for his Base and MGLE moments are $374k and $504k, respectively. The open marketplace has placed Nance Jr. out on this island, and let’s assume that as the market matures, he will shift closer and closer to our trend line. Applying Occam’s razor (“the simplest explanation is usually the right one”), there are two simple scenarios in which Nance Jr. falls back in line with the rest of the players:

Scenario A: Nance’s MGLE market cap is correct, and his Base moment is undervalued

Scenario B: Nance’s Base market cap is correct, and his MGLE moment is overvalued.

Exploring Scenario A, and assuming his MGLE market cap is correct, we find these players with similar MGLE market caps:

Jerami Grant ($484k)

Jusuf Nurkic ($502k)

Mike Conley ($521k)

Malcom Brogdon ($538k)

That’s five borderline All Stars with an average PER (Player Efficiency Rating) of 17.9. While we can’t directly correlate PER to Top Shot value, it seems safe to say that Nance Jr. and his PER of 13.2 don’t qualitatively or quantitively belong with this group.

Exploring Scenario B, and assuming his Base market cap is correct, we find these players with similar Base market caps:

Gary Harris ($368k)

DeAndre Jordan ($372k)

JaMychal Green ($382k)

Daniel Theis ($385k)

Qualitatively, Nance Jr. definitely fits in better with this crowd, and with an average PER of 13.9, they have the quantitative characteristics to match.

The Verdict: Scenario B seems to be far more likely than Scenario A, and Nance Jr.’s MGLE market cap appears to be overvalued. Assuming his Base market cap is correct, and plugging it into the function we defined earlier, we’d expect Nance Jr.’s MGLE moment to have a market cap of roughly $249k. With a circulation count of 179, that would bring the lowest asking price to $1,391 — more than half of the current lowest ask of $2,815.

Maxi Kleber

On the other end of the spectrum we have Mavericks power forward Maxi Kleber, the 29 year old German who rose to Top Shot notoriety after Mark Cuban incidentally pumped his bags a few weeks back.

“I get to enjoy knowing I own my Maxi Kleber dunk Moment, along with knowing the serial number and much more…I don’t know why anyone would sell a Maxi Moment. Maxi is a top 10 defender in the NBA, just saying!” - Mark Cuban

Kleber’s Series 1 Base and MGLE moments show market cap values of $1.25M and $370k, respectively. Taking a similar approach as before, there are two simple scenarios for explaining how Kleber moves back in line with the rest of the crowd:

Scenario A: Kleber’s Base market cap is correct, and his MGLE moment is undervalued

Scenario B: Kleber’s MGLE market cap is correct, and his Base moment is overvalued

Exploring Scenario A, and assuming his Base market cap is correct, we find these players with similar Base market caps:

Bam Adebayo ($1.1M)

De’Aaron Fox ($1.2M)

Jimmy Butler ($1.2M)

Christian Wood ($1.3M)

We don’t need much in-depth analysis to see that Kleber doesn’t belong alongside these players. This group brings home a whopping average PER of 22.6, markedly higher than Kleber’s 11.3.

Exploring Scenario B, and assuming Kleber’s MGLE market cap is correct, we find these players with similar MGLE market caps:

Markieff Morris ($348k)

Jarret Culver ($359k)

Josh Okogie ($373k)

OG Anunoby ($379)

This certainly passes the eye test, as Kleber fits in better with this group, and with an average PER of 10.0, this seems to be the most likely scenario.

The Verdict: Scenario B seems to be far more likely than Scenario A, and Kleber’s Base market cap appears to be overvalued. Assuming his MGLE market cap is correct, and plugging it into the function we defined earlier, we’d expect Kleber’s Base moment to have a market cap of roughly $583k. With a circulation count of 3,999, that would bring the lowest asking price to $146 — more than half of the current lowest ask of $315.

Why the MGLE Discount?

So what might explain the trend that Series 1 MGLE moments have a discounted market cap compared to their Base Set counterparts? It’s difficult to pinpoint what’s driving this market behavior, but I believe it’s due to the barrier to entry created by the price points. Here’s a chart that shows the percentage of purchasing Top Shot users by their largest single purchase:

As we can see, Top Shot users don’t have a bottomless bankroll to spend on bigger purchases. Regarding Series 1 moments, the median lowest asking price across Base moments (with an MGLE counterpart) is $244 - an amount that 39% of Top Shot users have previously spent on a single moment. Conversely, the median lowest asking price across MGLE moments is $1,477 - an amount that only 9% of Top Shot users are willing to invest in a single moment. It’s not rocket science, but it seems as though there is far more “equipped” demand for Base moments when you factor in the capital that Top Shot users have to invest.

That’s all for this week! If you’ve made it this far, thank you for reading, and if you’re enjoying this content, the best way you can help out is by sharing with a friend.

What do you do regarding players that have more than one base moment? I've found that whilst players with one S1base and one MGLE tend to have a base cap thats roughly 1.6--1.9x the MLG cap, players with more than one base moment are a lot closer to parity with the MGLE prices on each particular base set moment, and what to do with this confuses me. Thanks in advance and good post. I've kept an eye on this for a while and its been a good trading quantifier.

I think there are two other factors behind Kleber's valuation, which might contribute to the elevated price: 1) He's a foreign born player, I'd be curious to see whether there is a correlation between European (or other origins) and inflated prices as there is an expectation in the community that these players have a broader market; and 2) Kleber was the first moment ever minted by Top Shot (https://topshotexplorer.com/sets/2), at least some of the owners of this moment (myself included) are betting on the novelty of it increasing its long term value. Please keep up the work, enjoying it!