Challenges: Thinking Two Steps Ahead

Is investing in future MGLE Challenges a simple and effective strategy?

Love ‘em or hate ‘em, Challenges add an undeniable wrinkle to the Top Shot experience. One day you’re showing your friends just how bad your $9 pack was, and the next day you’re looking at a T.J. McConnell assist worth over $95. What a time to be alive.

Spend any time on Top Shot Twitter and you’re bound to see the latest Cool Cats theories swirling around, all attempting one thing: to get ahead of the official Challenge announcement. Buy the Challenge Moments ahead of the announcement and you’re looking at either a big payday, or a +EV Challenge; take your pick. In general, we see Moment valuations skyrocket when they are part of a Challenge. But what about instances where it doesn’t take much creativity to know which Moments will be required in a future Challenge? Are these great opportunities right under our nose, and we just don’t realize it? Let’s dive in and find out.

MGLE Challenges

As one of the “core” Top Shot Sets, MGLE Moments and Challenges have been around for quite some time. To give you a sense of just how long, we’re currently on the 26th MGLE Challenge. In Series 2, we can see that there have been 110 MGLE Moments minted. With each Challenge requiring 9 moments and factoring in the Challenge reward, that works out to 11 Challenges. After this current MGLE Challenge for DeMar DeRozan wraps up, we’ll be left with 3 Challenges, specifically for these players:

Joel Embiid

Shai Gilegous-Alexander

Cole Anthony

If we set aside MGLEs used in previous Challenges, that leaves 27 Moments that are set to be required for these future Challenges. Here’s a handy link to these 27 Moments in the Marketplace, as well as a list of the players:

The remaining Challenge Reward players are no slackers, by any stretch. We have a likely MVP finalist, a promising young star, and a notable rookie. So how are these remaining 27 Moments priced? Let’s head to the marketplace and take a closer look.

Past, Present, and Future

To kick things off, we need a way to reference the current prices of Series 2 MGLE Moments. One of the most convenient ways to do this is to compare them to the players’ lowest circulation count Base Moments. Here’s a scatter plot comparing MGLE and Base Set market caps:

As we can see, there’s a fairly consistent relationship between a player’s Base Set and MGLE market caps. Specifically, the MGLE market caps fall a bit lower than their Base Set counterparts. In order to determine if picking up future MGLE Challenge Moments is a good idea, we’ll need to understand if they’re valued roughly the same as past Challenge Moments that have effectively lost all of their utility.

Let’s make our scatter plot a bit more informative, color coding Moments based on whether or not they belong to a past, current, or future challenge.

Much clearer! It’s a bit hand-wavy at this point, but we can see that MGLE prices seem to factor in whether or not the Moment has future utility or not. Current and future MGLE Challenge Moments sit closer to our dashed line that represents an equal valuation between a player’s Base Set and MGLE Moments. In other words, these Moments that have future utility have a higher MGLE price tag than those that have already been involved in a Challenge. From this information it seems as though Moments’ future utility is already “priced-in”. This hand-wavy takeaway is nice and all, but let’s do a bit more quantitative analysis to make sure.

For each player we can calculate the ratio between its MGLE and Base Set market cap values. For example, a ratio of 0.5 indicates a player whose MGLE has half the valuation of their Base Set Moment. We can next take these ratios, and understand the distributions for players involved in past, current, and future Challenges:

If you’re intimidated by box plots, don’t worry, they’re pretty straight forward: The dark line in each box represents the median value for each group, and the colored box represents the middle 50%. The trend seems clear as day: players set to be involved in future Challenges have the most inflated MGLE valuations. We likely arrive at this situation due to there being an imbalance in supply and demand. Speculative buyers drive up demand for these Moments, while most owners are hesitant to sell before they’re involved in a Challenge - reducing supply.

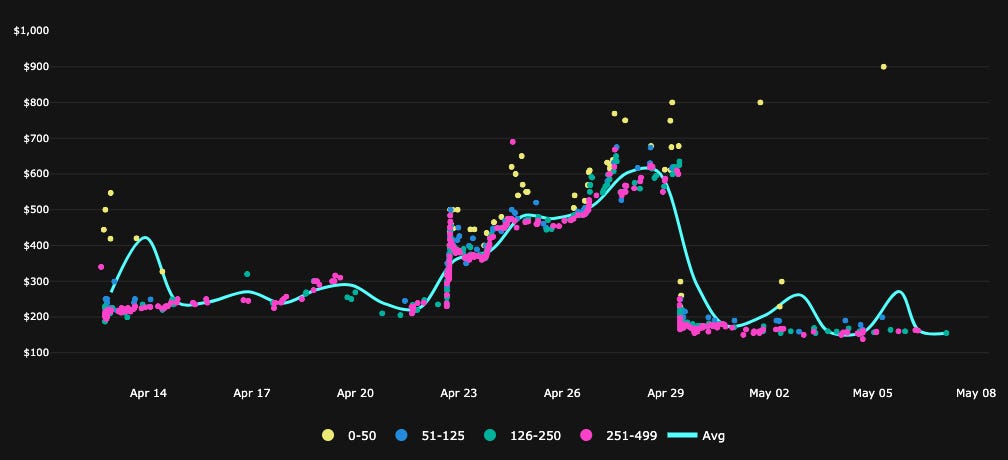

We’ve seen some MGLE Moments see significant price increases in the past, but it seems as though this is reserved for the heavily sought after Challenge Rewards, such as Luka. For example, here’s the price history of the DeAndre Jordan MGLE required for the Luka Challenge:

We can compare this to P.J. Washington’s MGLE Moment that was required for the arguably less-desirable Obi Toppin MGLE:

While the remaining Challenge Rewards are intriguing players, they certainly don’t have the same draw as Luka, so we can’t expect as significant of a run-up. As the number of remaining Challenges decreases, we’re left with a clearer picture of which Moments will be required for each remaining Reward, and arguably the in-Challenge utility becomes more priced-in.

As much as I had hoped to find and share a great opportunity on Top Shot, I think it’s just as important to share the dead ends and bumps in the road along the way. Knowing that MGLE Moments involved in future challenges seem to be appropriately priced-in is hopefully interesting information for both MGLE holders and prospective buyers.

That’s all for this week - I hope you enjoyed this article, and the best way you can help out is by sharing it with a friend!

Disclaimer: None of the above constitutes professional and/or financial advice. All opinions expressed on Minted Moment are from the personal research and experience of author, and are intended for educational purposes only.

This was very helpful, although you didn’t present a great buying opportunity you helped me greatly in not going through with this strategy, thank you great write up