It’s safe to say LeBron James has made a nice little career for himself - over his 18 seasons, he’s won four NBA Championships, four MVP awards, been named to 17 All-Star games … the list goes on. While Top Shot Moments can be considered collectibles, we can’t ignore the fact that they are also financial investments. So ask yourself this, what are you investing in by buying a no-look three from LeBron James? Under what situations is this a good investment?

LeBron has clearly cemented himself as one of the greatest basketball players of all time, so it’s likely that his true value on Top Shot has already been “priced-in”. Winning another championship, or getting bounced in the first round, our perception of LeBron - and arguably his value on Top Shot - wouldn’t change significantly. The most likely reason for our LeBron Moment increasing in value? The overall Top Shot market increasing in value. While it feels safe to make this assumption, we can utilize some common financial measurements to prove this. Let’s dive in.

Follow the Leader

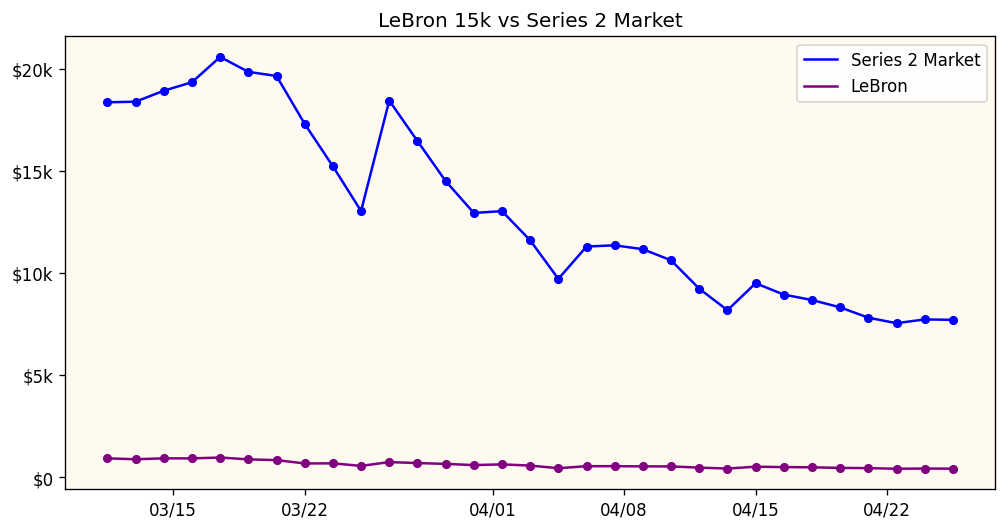

The first step in understanding how closely our LeBron Moment follows the broader market is to track the market’s performance over time. For simplicity, since this LeBron Moment is a Series 2 Base Set Moment, we’ll be tracking the ups and downs of this specific Set from early March onward. Here’s a chart showing the performance of the Series 2 Base Set market, and the LeBron no-look three over time:

Right away, we can obviously see that it’s not easy to compare our LeBron Moment to the overall Series 2 Base Set market - they’re orders of magnitude different. Instead of comparing pure dollar amounts, we can better understand the relationship by comparing the percentage increases and decreases (also known as return) on a rolling 36-hour basis. First up, let’s take a look at the Series 2 Base Set market from a percentage return point of view:

Here we can see that we have returns ranging from about -20% to +40%. We can interpret a 40% return as the price of the Series 2 Base Set increasing by 40% compared to 36 hours earlier. So how do things look when we add King James?

Much better! We can immediately see just how much the two are in lockstep with each other. From a percentage return point of view, the two are very tightly coupled. But how do we know that LeBron is a special case? Could the majority of Moments follow the market this closely? To answer that question, we can borrow a measurement from the finance world: beta.

Understanding Beta

Beta is a measurement of market risk or volatility, and it specifically indicates how much the price of an asset (in our case a Moment) tends to fluctuate up and down compared to the market (Series 2 Base Set). Beta allows us to better understand if an asset tends to move up and down just as sharply as the broader market. I won’t bore you with how to calculate beta, but it’s important to understand how we can interpret a beta value.

Beta of 1: A beta of 1 indicates an asset that will move in the same direction as the market, and by the same amount.

Beta greater than 1: A beta greater than 1 indicates an asset that is more volatile than the overall market. On days when the market is up, it can see an even larger increase, and on days when the market is down, it can take an even bigger hit.

If our LeBron Moment is truly in lockstep with the market, it should have a value very close to 1. Calculating the beta value for over 120 Base Set Moments, we find that LeBron does, in fact, have the beta value closets to 1, specifically 0.99. So our hunch seems correct - LeBron’s value on Top Shot is well established, and its fluctuations are primarily due to the broader market’s ups and downs.

So what does a Moment with a beta greater than 1 look like? Not surprisingly, many rookies fall into this category - so much so that rookies account for the nine of the ten highest beta values across all Series 2 Base Set Moments.

Let’s consider this chart comparing Anthony Edward’s 4k LE layup to the Series 2 Base Set market:

This Anthony Edwards Moment has a beta value of 1.38, second highest among all analyzed Base Set Moments. We can see multiple instances where the price exceeds the market on positive days, and falls even lower on negative days. This type of behavior suggests that rookies like Edwards may have more systematic risk. When the sky is falling, these rookies may fall harder than established superstars like LeBron.

Final Thoughts

So why is investing LeBron James a bet on Top Shot? As we saw, out of all Moments in the Series 2 Base Set, the LeBron no-look three most closely follows the movement of the market; so much so that it begs the question if this Moment actually dictates the market. Consider the fact that LeBron also suffered a serious ankle injury on March 20th, yet we see no signs of this in his chart. There appears to be very little player-specific risk at play with LeBron, and this makes sense. He’s cemented himself as an all-time great, and that’s not changing anytime soon. If you’re bullish on LeBron Moments, you’re hopefully also bullish on the Top Shot market.

That’s all for this week - I hope you enjoyed this article, and the best way you can help out is by sharing it with a friend!

Disclaimer: None of the above constitutes professional and/or financial advice. All opinions expressed on Minted Moment are from the personal research and experience of author, and are intended for educational purposes only.

Another valuable component of Lebron is his moments have the highest liquidity. The more popular the superstar, the more buyers will pay for his moment. Lebron is one of the most popular athletes of all time, you can always count on a market for him.